Workers’ compensation can be a complicated issue to navigate. Every state has different legislation regarding workers’ compensation, and the relevant laws can change regularly. At The Law Office of William L. Phalen, we often receive questions from employees who want to know the workers’ compensation process and how a claim can be filed.

If you are a worker who has suffered a work-related injury in Kansas or Missouri, you may have a workers’ comp case. If you are eligible for workers’ comp, you deserve to recover compensation for your lost wages and medical expenses. With a workers’ comp attorney from our firm on your side, you may be able to file a successful workers’ comp claim and recover the compensation you deserve.

To help you better understand workers’ comp, we have compiled eight facts that may surprise you.

1. All Businesses Are Accountable to the State’s Workers’ Compensation Laws

Even in states where workers’ comp is not mandatory, businesses may not be able to forego it because they are still accountable to the state’s workers’ comp laws. However, some companies choose to remain uninsured.

If your employer does not have workers’ compensation insurance, you may be able to file a workers’ comp claim with your state or file a personal injury suit against your employer. If both are available options in your state, consult with an experienced attorney who can help you determine whether you should pursue a personal injury lawsuit or a workers’ comp claim.

2. Workers’ Compensation Does Not Cover Pain and Suffering

In this instance, a personal injury lawsuit can financially compensate for pain and suffering. However, workers’ comp will not. Instead, workers’ comp covers only lost wages, medical expenses and financial support for a disability.

If you have been injured in an accident at work, you may want to pursue a personal injury lawsuit to be financially compensated for your pain and suffering.

3. Occupational Accident Insurance (OAI) Is Not a Substitute for Workers’ Comp

While OAI is a sort of alternative to workers’ comp, it is not a substitute. OAI provides substandard coverage for employees and employers. In some states, it may even be considered unlawful for insurance agents to offer OAI as a substitute for a workers’ compensation insurance plan.

An occupational accident insurance plan contains limits for coverage, and workers’ comp insurance generally has higher coverage limits. With OAI, you may win claims for punitive damages and pain and suffering. If your expenses exceed the coverage limits, your employer will need to cover the additional costs. If you have been injured on the job, consult an attorney to determine how to file a claim depending on what coverage your employer offers.

4. Receiving Workers’ Compensation Foregoes Your Right to a Lawsuit

If you receive workers’ compensation benefits, you may be foregoing your right to file a lawsuit against your employer. When you make a workers’ comp claim, you will not have to deal with the unpredictability of a lawsuit, and if you qualify for benefits, you might begin receiving them right away.

While there are several benefits to filing a workers’ comp claim, you may choose to pursue a lawsuit instead. With a lawsuit, you may be able to recover punitive damages, which you cannot do with a workers’ comp claim. Additionally, with workers’ compensation, your benefits are limited to what is allowed by your state’s workers’ comp laws and may be only a percentage of your pre-injury wages.

If you choose to file a lawsuit, you will not be limited to workers’ compensation benefit amounts. In addition to lost wages, you may be able to receive compensation for:

- Pain and suffering

- Punitive damages

- Medical treatment

- Permanent impairment

Punitive damages could be a greater sum of money than the actual damages you incurred, particularly if your employer displayed egregiously bad behavior that led to your injury.

To begin a lawsuit, you would file certain documents. Speak with an attorney to make sure you file your personal injury lawsuit in the appropriate jurisdiction. Filing a lawsuit against your employer can be a complex process, and we do not recommend attempting to file a lawsuit on your own.

5. You Do Not Have to Be Injured at the Physical Workplace

The injury must happen “within the scope of employment,” meaning the injury does not necessarily have to occur at the physical workplace. Instead, the accident can happen while running errands for the employer or going to a mandatory work event, for example. Typically, if you were getting paid for the work you were doing and were injured while performing the task, you may have a workers’ comp claim.

6. Insurance Companies Pay Workers’ Compensation Benefits — Not the State

Many mistakenly believe that the state pays out workers’ comp benefits. However, benefits are actually handled by private insurance companies paid for by businesses with workers’ compensation insurance.

Though some workers’ comp laws are uniform on the federal level and across states, many workers’ comp laws vary from state to state. As an employee, you may want to speak with your employer and revisit your state’s specific workers’ compensation laws.

7. You Can Receive Benefits Even After Returning to Work

Even after you return to work, you may still be able to receive workers’ compensation benefits. Your situation may permit continued benefits if you make less than what you made before your injury or if you are receiving benefits for permanent partial disability.

Along with a more secure financial position, returning to work can allow you to enjoy a more active lifestyle and give you a confidence boost. You will also be able to reconnect with your coworkers, and these social connections can make your road to recovery easier.

8. Most Workers’ Compensation Benefits Will Not Be Taxed

For the most part, workers’ compensation benefits will not be taxed,, and workers’ comp insurance companies do not send out W-2 forms. These benefits are exempt from taxes, including the payments made to loved ones after a fatal workplace accident.

However, there are certain cases in which workers’ comp may be fully or partially taxable. Typically, these cases arise when an employee returns to work or is utilizing other benefits.

- If you return to work at the job where you were injured, your wages are taxable.

- If you go back to work and take a light-duty position, your wages are taxable.

- If you receive Social Security Disability benefits, part of these benefits may be taxable.

- If you choose to retire after your injury, your retirement plan benefits may be taxed.

Should You File a Workers’ Compensation Claim?

After you are injured at work, you may want to file a workers’ comp claim as soon as possible. To receive workers’ comp benefits, you must make your claim in a limited amount of time. If you do not act promptly, your claim may be denied.

Are You Eligible for Workers’ Comp?

In Missouri and Kansas, workers’ comp laws exist to protect employees injured on the job. You may be able to file a claim if you are an employee who was injured at work, your employer has a workers’ comp plan and you are considered an employee, not a contractor. Some of the most common causes of workplace injuries are:

- Overexertion

- Struck by object

- Repetitive motion

- Slip and fall accidents

- Motor vehicle incidents

- Caught in objects or equipment

According to workers’ compensation statistics, the most common causes of workplace deaths are:

- Falls

- Transportation

- Intentional injury

- Explosions and fires

- Contact with equipment and objects

- Exposure to harmful environments or substances

Typically, workers’ comp will not cover:

- An injury that occurs while you are under the influence of alcohol or drugs

- An injury that occurs while you are commuting to work or home

- An injury that occurs while you are violating a company policy

- An injury that occurs while you are committing a crime

- An injury caused by horseplay or fighting

- A psychiatric injury, such as stress

- A self-inflicted injury

If you are not completely sure what is covered by workers’ comp, you can speak with your employer or an attorney.

How Do You File a Workers’ Comp Claim?

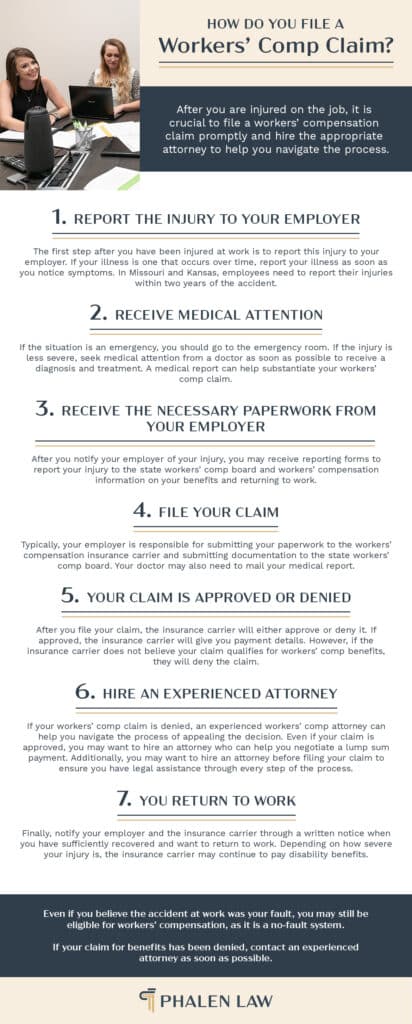

After you are injured on the job, it is crucial to file a workers’ compensation claim promptly and hire the appropriate attorney to help you navigate the process. The following are the steps to filing a workers’ compensation claim:

- Report the injury to your employer: The first step after you have been injured at work is to report this injury to your employer. If your illness is one that occurs over time, report your illness as soon as you notice symptoms. In Missouri and Kansas, employees need to report their injuries within two years of the accident.

- Receive medical attention: If the situation is an emergency, you should go to the emergency room. If the injury is less severe, seek medical attention from a doctor as soon as possible to receive a diagnosis and treatment. A medical report can help substantiate your workers’ comp claim.

- Receive the necessary paperwork from your employer: After you notify your employer of your injury, you may receive reporting forms to report your injury to the state workers’ comp board and workers’ compensation information on your benefits and returning to work.

- File your claim: Typically, your employer is responsible for submitting your paperwork to the workers’ compensation insurance carrier and submitting documentation to the state workers’ comp board. Your doctor may also need to mail your medical report.

- Your claim is approved or denied: After you file your claim, the insurance carrier will either approve or deny it. If approved, the insurance carrier will give you payment details. However, if the insurance carrier does not believe your claim qualifies for workers’ comp benefits, they will deny the claim.

- Hire an experienced attorney: If your workers’ comp claim is denied, an experienced workers’ comp attorney can help you navigate the process of appealing the decision. Even if your claim is approved, you may want to hire an attorney who can help you negotiate a lump sum payment. Additionally, you may want to hire an attorney before filing your claim to ensure you have legal assistance through every step of the process.

- You return to work: Finally, notify your employer and the insurance carrier through a written notice when you have sufficiently recovered and want to return to work. Depending on how severe your injury is, the insurance carrier may continue to pay disability benefits.

Even if you believe the accident at work was your fault, you may still be eligible for workers’ compensation, as it is a no-fault system. If your claim for benefits has been denied, contact an experienced attorney as soon as possible.

Why You Should Hire a Workers’ Comp Attorney

While pursuing workers’ comp benefits, you may face some unexpected challenges. For example, you may need to prove that your injury is work-related, or your employer may claim you are not eligible for workers’ comp coverage. Perhaps your workers’ comp benefits are delayed, or you don’t receive your checks at all. If you struggle to receive the benefits you deserve, you may want to work with a workers’ comp attorney. Consider the following benefits of hiring a workers’ comp attorney:

- A free case evaluation

- Answers to legal questions

- On-time filing for your claim

- Smaller reduction of your other benefits

- Legal support if your workers’ comp claim is denied

- Legal support if your disability is challenged

- Legal representation during a workers’ comp hearing

- Assistance collecting evidence and completing paperwork

- Legal assistance if your preexisting condition makes your claim more complex

- Legal support if the insurance carrier is interfering with your ability to get treatment

Workers’ comp attorneys in Kansas and Missouri will be familiar with workers’ compensation laws in the state where you have been injured, such as the statute of limitations. With a reliable attorney on your side, you can rest assured that you will have someone to help you through the process of filing your claim on time and seeking the compensation you deserve.

Contact The Law Office of William L. Phalen for a Free Initial Consultation

At The Law Office of William L. Phalen, we have been practicing in the area of workers’ compensation for more than two decades. Our firm provides experienced representation, and we understand the complexities of workers’ comp insurance practices. We will listen to your needs and fight for your legal rights.

We handle all workplace injuries, from carpal tunnel claims to workplace fatalities. You will receive a dedicated legal assistant or paralegal who will help move your case along and who is available every time you call to ask questions. Contact us at Phalen Law Firm for a free initial consultation during which our attorneys will review your workers’ comp case.

Sources

William L. Phalen

For 30 years, Bill Phalen has been representing families and workers whose lives have been devastated by workplace injuries, reckless drivers and the negligence of others. When tragedy needlessly strikes – because of the irresponsible behavior of an employer, corporation or an insurance company – Bill Phalen is an advocate for the people, always representing David in the fight against Goliath. Bill’s strong convictions have led to successful cases at the Court of Appeals and Kansas Supreme Court.

The people in this office have been a part of this community for a lifetime and working with them has helped me feel as if I was a part of this great community as well.